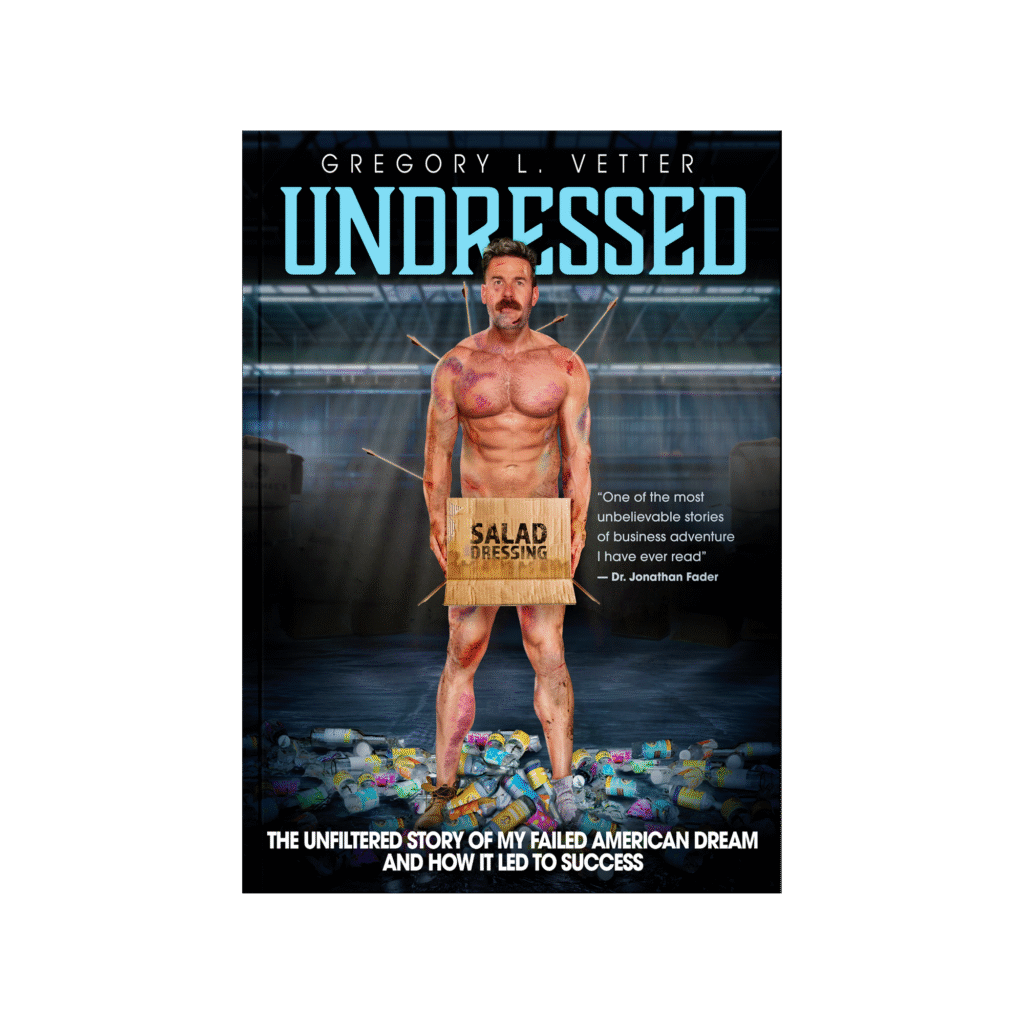

On this episode of Business Owners Tell All: What It Takes, host Jamie Seeker interviews Gregory Vetter, co-founder of Tessemae’s and current CEO of Alta Fresh Foods. In one of our most honest and powerful conversations yet, Greg walks us through the financial lessons entrepreneurs often only learn the hard way—from bootstrapping and investor mistakes to a board takeover that ended in Chapter 11 bankruptcy.

This is more than a business interview—it’s a story of failure, resilience, freedom, and finding joy on the other side.

💰 Why Financial Lessons from Entrepreneurs Matter

Most business podcasts skip the messy middle, but that’s where the real lessons live. Greg’s journey—from selling salad dressing out of his fridge to leading a national food brand—offers priceless insight into the financial challenges entrepreneurs face while scaling.

“Every fear I’ve ever had was exposed in the journey. Once that happens, you can approach life and business very differently.” — Gregory Vetter

Related episode: The Road to Approval: Zoning Out the Noise with Jake Malott

🥗 Alta Fresh Foods: Smarter Financial Growth

Greg’s current company, Alta Fresh Foods, is a lean, efficient food operation with no outside investors. The focus is on solving real retail problems—like food waste and labor costs—with a system called “master kitting.”

“This business isn’t sexy—but it solves a problem. And that’s what makes it profitable.” — Gregory Vetter

Related post: The Joy Prescription: Inside the Vet Revolution to Thrive, Not Just Survive

🔥 Lessons Learned: Ego, Investors, and Oil Spills

Greg shares one of the most unforgettable stories in Undressed—a 55-gallon drum of oil spilled in a storage unit, costing thousands.

“You can’t half-ass any part of growth. ‘Move fast and break things’ sounds great until you’re cleaning it up with kitty litter.”

He also opens up about how media hype and investor attention became financial distractions. Instead of helping the business grow, they pulled it off course.

“Hype is ego. I thought if we were in magazines, everything would click. It didn’t.”

📉 When Validation Leads to Financial Loss

Greg admitted that his desire to be liked by investors clouded his judgment early on. He ignored red flags and accepted capital on terms that ultimately worked against him.

“When you’re starved for validation, the first person who offers it looks like a savior.”

He now coaches other entrepreneurs through his accelerator, HomeGrown Brands, to help them build smarter and avoid those traps.

Related post: Charging Ahead: How Joseph Nagle Is Powering the EV Revolution at Home

🙌 From Bankruptcy to Breakthrough

Eventually, Greg’s board staged a takeover, leading to Chapter 11 bankruptcy—even though he had evidence in his favor. Instead of destroying him, it gave him freedom.

He found his faith, his family, and a new way to lead.

“There are four things money can’t buy: your health, your soul, your time, and your children’s love. If you’re in control of those, you can stay in the storm forever.”

Related episode: In the Eye of the Storm: Standing Tall with Attorney Juan Cruz

🎧 Listen to the Full Episode

If you’ve ever struggled with financial decisions, questioned your investor relationships, or just want a brutally honest look behind the scenes of entrepreneurship, don’t miss this episode.

🎙️ Listen now

📘 Get the book

🌐 Explore Greg’s work: gregoryvetter.com

🔁 More Financial Lessons from Entrepreneurs

- From Foundation to Finish: How Scott Rodwin Built His Dream Firm

- Behind the Curtain: Lights, Leadership & the Art of Corporate Event Production

- Legacy in Progress: How Ryan Teicher is Reinventing REDCOM